Choosing the best credit card in India is a crucial financial decision that can unlock a world of rewards, savings, and exclusive privileges. With hundreds of options available, each tailored to different spending habits and lifestyles, finding the right card requires careful analysis. In this comprehensive guide, we’ll break down everything you need to know about the best credit cards in India for 2025, including top recommendations, category-wise winners, expert tips, and answers to your most pressing questions.

- Why You Need the Best Credit Card

- How to Choose the Best Credit Card

- Top 10 Best Credit Cards in India 2025

- Best Credit Card by Category

- 1. Best Credit Card for Cashback

- 2. Best Credit Card for Travel

- 3. Best Credit Card for Fuel

- 4. Best Credit Card for Shopping

- 5. Best Credit Card for Premium/Luxury Benefits

- Key Features to Compare

- Benefits of Owning the Best Credit Card

- Risks and How to Avoid Them

- Tips for Maximizing Credit Card Benefits

- Frequently Asked Questions

- Which is the best credit card for beginners?

- Can I have more than one credit card?

- Does applying for a credit card affect my credit score?

- What documents are required to apply?

- How do I avoid annual fees?

- What are the best credit cards in India for 2025?

- Which is the best credit card for airport lounge access in India?

- What are the best credit cards in India for 2025?

- Which credit card is best for fuel purchases?

- Which credit card is best for travel benefits in India?

- Which is the best credit card for lounge access and travel in 2025?

- What is the best credit card for movie ticket offers?

- Which is the best credit card to pay insurance premiums in India?

- Which bank offers the best credit cards in India?

- What are the top 5 best credit cards in India 2025?

- Which is the best beginner credit card in India?

- Are there any credit cards that offer both travel and fuel benefits?

- Final Thoughts

Why You Need the Best Credit Card

A best credit card is more than just a payment tool. It’s a gateway to:

- Cashback and savings on everyday purchases

- Reward points for travel, shopping, and dining

- Exclusive privileges like airport lounge access and concierge services

- Building your credit score for future loans and financial products

Selecting the right card ensures you get the most value from your spending and enhances your financial flexibility.

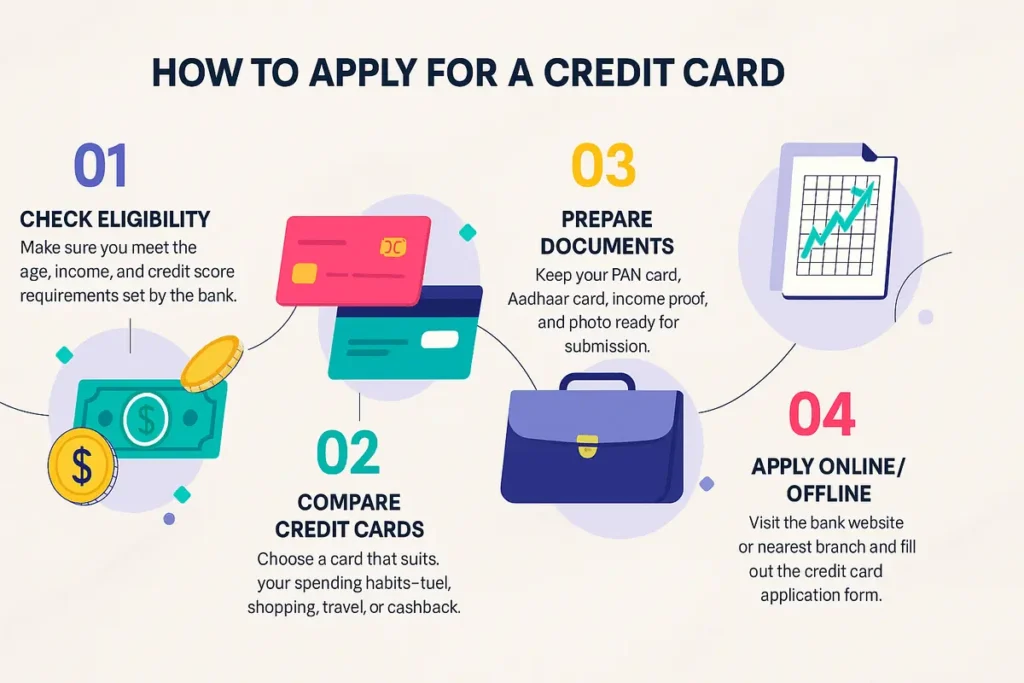

How to Choose the Best Credit Card

Consider the following things carefully prior to applying for a credit card:

- Spending habits: Do you spend more on travel, shopping, fuel, or dining?

- Annual fees vs. rewards: Are the benefits worth the fee?

- Eligibility: Does your income and credit score meet the requirements?

- Interest Rates: What annual percentage rate (APR) will apply if you don’t pay off the full balance?

- Additional perks: Look for insurance, cashback, and milestone rewards.

Top 10 Best Credit Cards in India 2025

Our expert roundup of India’s top credit cards for 2025 covers all types of users—whether you’re budget-conscious or reward-focused.

| Card Name | Joining Fee | Annual Fee | Key Benefits |

|---|---|---|---|

| HDFC Diners Club Black Metal Edition | ₹10,000 | ₹10,000 | Unlimited airport lounge access, high base rewards, premium memberships |

| Axis Bank Reserve Credit Card | ₹50,000 | ₹50,000 | Unlimited lounge access, luxury hotel memberships, golf, low forex markup |

| HDFC Regalia Gold Credit Card | ₹2,500 | ₹2,500 | 5X rewards on select brands, lounge access, milestone vouchers |

| YES Bank Paisabazaar PaisaSave Credit Card | ₹0 | ₹499 | 3% cashback on e-commerce, 1.5% on all spends, UPI support |

| Cashback SBI Card | ₹999 | ₹999 | 5% cashback on online, 1% on offline spends, fuel surcharge waiver |

| Axis Atlas Credit Card | ₹5,000 | ₹5,000 | Travel rewards, lounge access, milestone EDGE Miles |

| HSBC TravelOne Credit Card | ₹4,999 | ₹4,999 | 2x travel rewards, lounge access, golf, hotel/airline point transfers |

| Tata Neu Infinity HDFC Bank Credit Card | ₹1,499 | ₹1,499 | Up to 10% value-back on Tata Neu, lounge access, UPI rewards |

| IndianOil RBL Bank XTRA Credit Card | ₹1,500 | ₹1,500 | Up to 8.5% fuel savings, fuel points, annual fee waiver on high spends |

| ICICI HPCL Super Saver Credit Card | ₹500 | ₹500 | Cashback on HPCL fuel, fee waiver on high spends |

Note: HDFC Infinia is an invite-only card and not included in most public lists, but it remains a top pick for high net-worth individuals.

Best Credit Card by Category

1. Best Credit Card for Cashback

- Earn 5% cashback when you shop online and 1% on offline spending with the Cashback SBI Card.

- YES Bank Paisabazaar PaisaSave Card gives you 3% cashback on e-commerce purchases and 1.5% cashback on all other spends, including UPI payments.

2. Best Credit Card for Travel

- HDFC Diners Club Black Metal Edition: Unlimited lounge access, high rewards on travel bookings, and premium memberships.

- Axis Atlas Credit Card: Accelerated rewards on travel, milestone EDGE Miles, extensive lounge access.

3. Best Credit Card for Fuel

- Maximize fuel savings with the IndianOil RBL Bank XTRA Card: get up to 8.5% off on IOCL fuel, bonus points, and a waived annual fee on high usage.

- ICICI HPCL Super Saver: Cashback on HPCL fuel, low fees, and additional benefits.

4. Best Credit Card for Shopping

- HDFC Regalia Gold: 5X rewards on top brands, milestone vouchers, and complimentary memberships.

- Tata Neu Infinity HDFC: Up to 10% value-back on Tata Neu and partners, UPI rewards.

5. Best Credit Card for Premium/Luxury Benefits

- Axis Bank Reserve: Unlimited lounge access, luxury hotel memberships, and golf privileges.

- HDFC Infinia Metal (Invite-only): Highest reward rates, unlimited lounge and golf, premium insurance.

Key Features to Compare

When searching for the best credit card, compare these features:

- Reward rate: Percentage value of rewards/cashback earned per rupee spent

- Lounge access: Number of complimentary domestic/international visits

- Milestone benefits: Extra rewards or vouchers on reaching spend targets

- Annual/joining fees: Consider if the benefits justify the cost

- Redemption options: Flexibility to redeem for cash, travel, vouchers, or merchandise

- Forex markup: Charges on international transactions

- Eligibility criteria: Minimum income, credit score, and documentation required.

Benefits of Owning the Best Credit Card

- Maximized savings: Earn cashback, discounts, and rewards on regular expenses.

- Exclusive privileges: Access to airport lounges, golf courses, hotel memberships, and more.

- Financial flexibility: Convert large purchases to EMIs, get emergency credit, and build a strong credit score.

- Security: Fraud protection, two-factor authentication, and insurance coverage.

- Convenience: Contactless payments, UPI integration, and instant approvals with select banks.

Risks and How to Avoid Them

While the best credit card offers numerous benefits, be aware of these risks:

- High interest rates: Carrying a balance can lead to significant interest charges, sometimes up to 27% per annum.

- Annual fees: Some cards have high fees that may not be justified unless you maximize the rewards.

- Fraud: Credit card fraud is a risk; always use secure websites and enable two-factor authentication.

- Overspending: Easy credit can lead to debt traps if not managed responsibly.

Tips to avoid risks:

- Make sure to pay your credit card bill in full and before the due date.

- Monitor your transactions regularly.

- Use cards with robust security features.

- Choose cards with annual fee waivers on high spends if you’re a heavy user.

Tips for Maximizing Credit Card Benefits

- Match card to your lifestyle: Select a card that aligns with your primary expenses (travel, dining, fuel, shopping).

- Leverage milestone rewards: Plan big purchases to unlock bonus points or vouchers.

- Combine cards: Use a cashback card for online spends and a fuel card for petrol purchases for optimal rewards.

- Redeem points smartly: Convert reward points for maximum value, such as flight tickets or high-value vouchers.

- Track offers: Banks frequently run limited-time offers for extra cashback or discounts—stay updated via their apps or websites.

Frequently Asked Questions

Which is the best credit card for beginners?

Can I have more than one credit card?

Does applying for a credit card affect my credit score?

What documents are required to apply?

How do I avoid annual fees?

What are the best credit cards in India for 2025?

The best credit cards in India for 2025 offer a mix of cashback, travel perks, lounge access, and low annual fees. Top contenders include:

HDFC Regalia Credit Card – Ideal for frequent travelers with lounge access and reward points.

Axis Bank ACE Credit Card – Great for cashback on everyday spending, including utility bills.

SBI Cashback Card – Offers 5% cashback on online shopping with no merchant restrictions.

ICICI Amazon Pay Credit Card – Perfect for online shoppers and Prime members.

Axis Magnus Credit Card – Premium card with travel, lifestyle, and dining benefits.

Your ideal choice depends on how you spend—whether it’s on fuel, travel, shopping, or entertainment.

Which is the best credit card for airport lounge access in India?

The best credit card for airport lounge access in India includes HDFC Diners Club Black, Axis Magnus, and SBI Elite Card, offering complimentary access to domestic and international lounges.

What are the best credit cards in India for 2025?

The best credit cards in India 2025 are those that offer high rewards, low fees, and extra perks. Top choices include HDFC Regalia, ICICI Coral, and Axis Ace.

Which credit card is best for fuel purchases?

Looking for fuel savings? The best credit card for fuel in India is the IndianOil Axis Bank Card, which offers up to 4% cashback on fuel spends and surcharge waivers.

Which credit card is best for travel benefits in India?

The best credit card for travel benefits in India includes HDFC Infinia, SBI Elite, and American Express Platinum Travel Card, offering air miles, hotel stays, and complimentary lounge access.

Which is the best credit card for lounge access and travel in 2025?

In 2025, the best all-rounder for lounge access and travel is the Axis Magnus Credit Card, offering domestic/international lounge visits, flight upgrades, and travel insurance.

What is the best credit card for movie ticket offers?

The best credit card for movie tickets is the ICICI Coral Credit Card or Axis Neo, both offering BOGO (Buy 1 Get 1) on BookMyShow and Paytm Movies every month.

Which is the best credit card to pay insurance premiums in India?

The best credit card for insurance premium payment is HDFC Regalia or SBI Card PRIME, offering reward points on insurance transactions without capping or surcharges.

Which bank offers the best credit cards in India?

In India, HDFC Bank, Axis Bank, and SBI Cards offer the best credit cards with competitive reward programs, lounge access, cashback, and EMI facilities.

What are the top 5 best credit cards in India 2025?

The top 5 best credit cards in India 2025 are:

HDFC Regalia Credit Card

Axis Magnus Credit Card

SBI Cashback Card

ICICI Coral Credit Card

American Express SmartEarn Card

Which is the best beginner credit card in India?

The best credit card for beginners in India is the SBI SimplyCLICK or ICICI AmazonPay Credit Card, offering easy approval, cashback on online shopping, and low annual fees.

Are there any credit cards that offer both travel and fuel benefits?

Yes, the HDFC Bharat Cashback Credit Card and IndianOil Citi Card provide fuel savings and travel rewards, making them ideal for frequent travelers.

Final Thoughts

There is no single best credit card for everyone in India. The ideal card depends on your spending habits, financial goals, and lifestyle preferences. Whether you want maximum cashback, premium travel perks, or fuel savings, there’s a card tailored for you. Always compare the latest offers, read the fine print, and choose a card that offers the most value for your needs.

Remember, the best credit card is one that not only rewards your spending but also helps you build a strong financial future. Make your choice wisely, use your card responsibly, and enjoy the world of benefits that comes with it.

Disclaimer: The information provided here is based on the latest data available as of July 2025. Card features, fees, and offers may change, so always check with the issuing bank before applying.

Comments (0)